Bust A Cap

Russian oil export price cap’s impetus, execution viability, and possible improvements

I recently had the opportunity to sit down and chat at length with Jack Farley on the Forward Guidance podcast about the crude market’s truly bizarre year. Check out the video of the full interview for free here.

The proposed price cap on Russian oil exports has been roundly mocked by industry participants as wishful thinking, but at the same time it demonstrates refreshingly creative policy making in a moment of especially high stakes.

It’s important to remember that the proposal always aimed to achieve two objectives: 1) cutting Russian revenues, and 2) mitigating exploding energy prices amidst a broader global inflationary crisis.

Given the slow pace of negotiation progress and the many logistical challenges of the plan still seemingly unaddressed, it’s reasonable to question whether the energy price spike avoidance priority is winning out over pressure on Moscow.

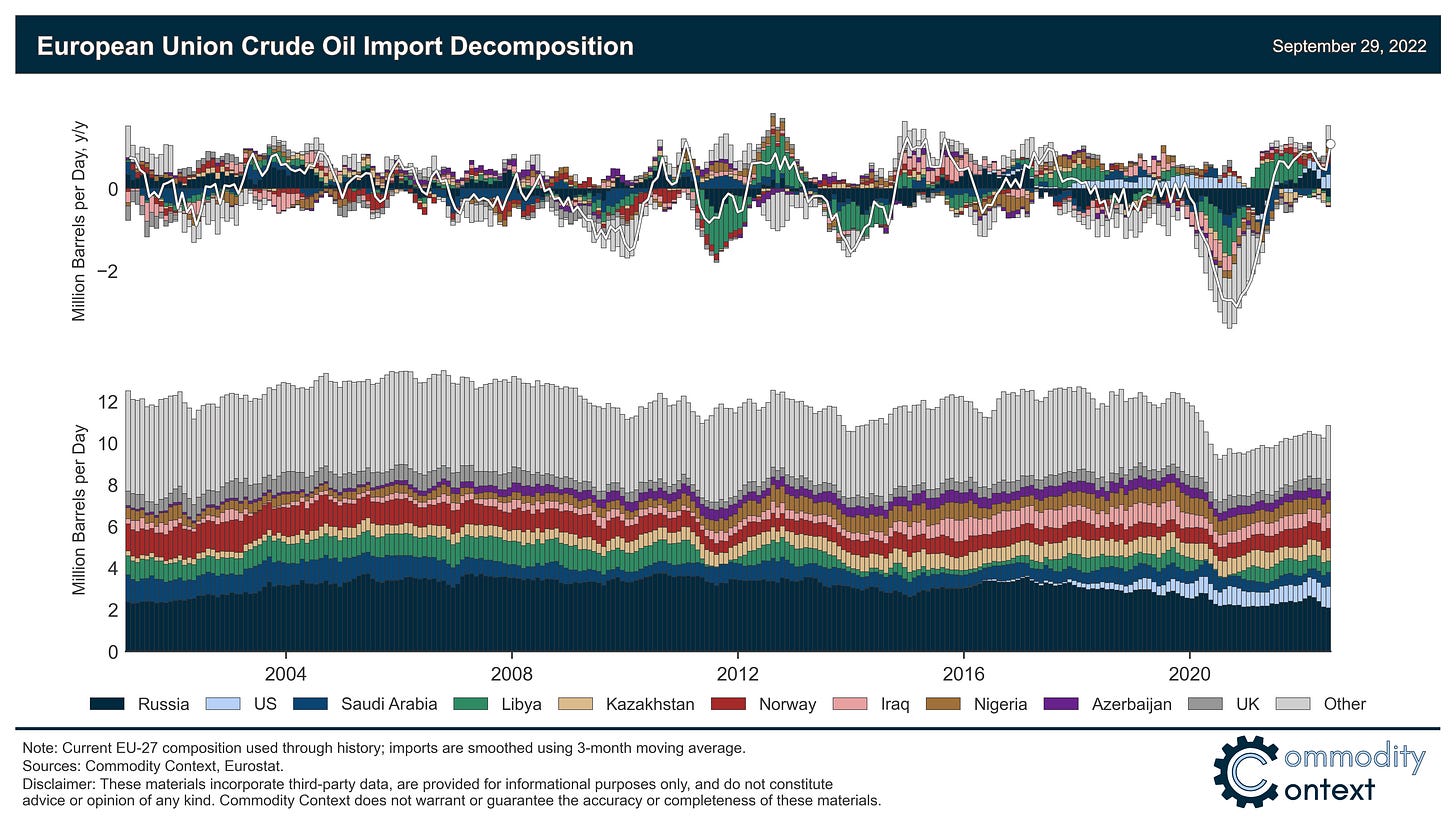

Absent some kind of mechanism—like the proposed price cap—that would allow Russia-to-Europe shipments to continue, more than 1.5 MMbpd of Russian crude oil that continues to flow to Europe will be cut off by the EU ban on Russian seaborne crude imports on December 5th.

One way to improve the effectiveness and enforcement efficiency of the price cap—if that truly was a goal—that circumvents many of the current shortcomings would be for Western governments to establish a dedicated entity that would act as the sole purchaser of Russian oil before selling the barrels on to private participants, drastically narrowing the scope for cheating and enforcement monitoring.

Can you eat your cake and have it, too? This is the question at the heart of the debate surrounding the proposed price cap on Russian oil exports. On the one hand, the proposal has been roundly mocked by industry participants as wishful thinking and on the other, it demonstrates refreshingly creative policy making in a moment of especially high stakes.

But for all the good intentions, negotiations have been sporadic, progress slow, and leaks of where we’re at in the process haven’t been especially promising. To wit, we got headlines earlier this week that the price cap plans were being “delayed” because of disagreements within the bloc—though I was assured by many sanctions-watchers that the headline was misleading—and then yesterday we got news that the EU is, indeed, still planning to go ahead with the plan.

Note: There are many legal details that have yet to be specified or resolved, so for the purposes of this post let’s just assume that G7 governments and/or the EU specifically pass a law or set of laws that require purchases of Russian crude not exceed a certain price level and violation results in some kind of legal penalty.